Asset Evaluation Case Study

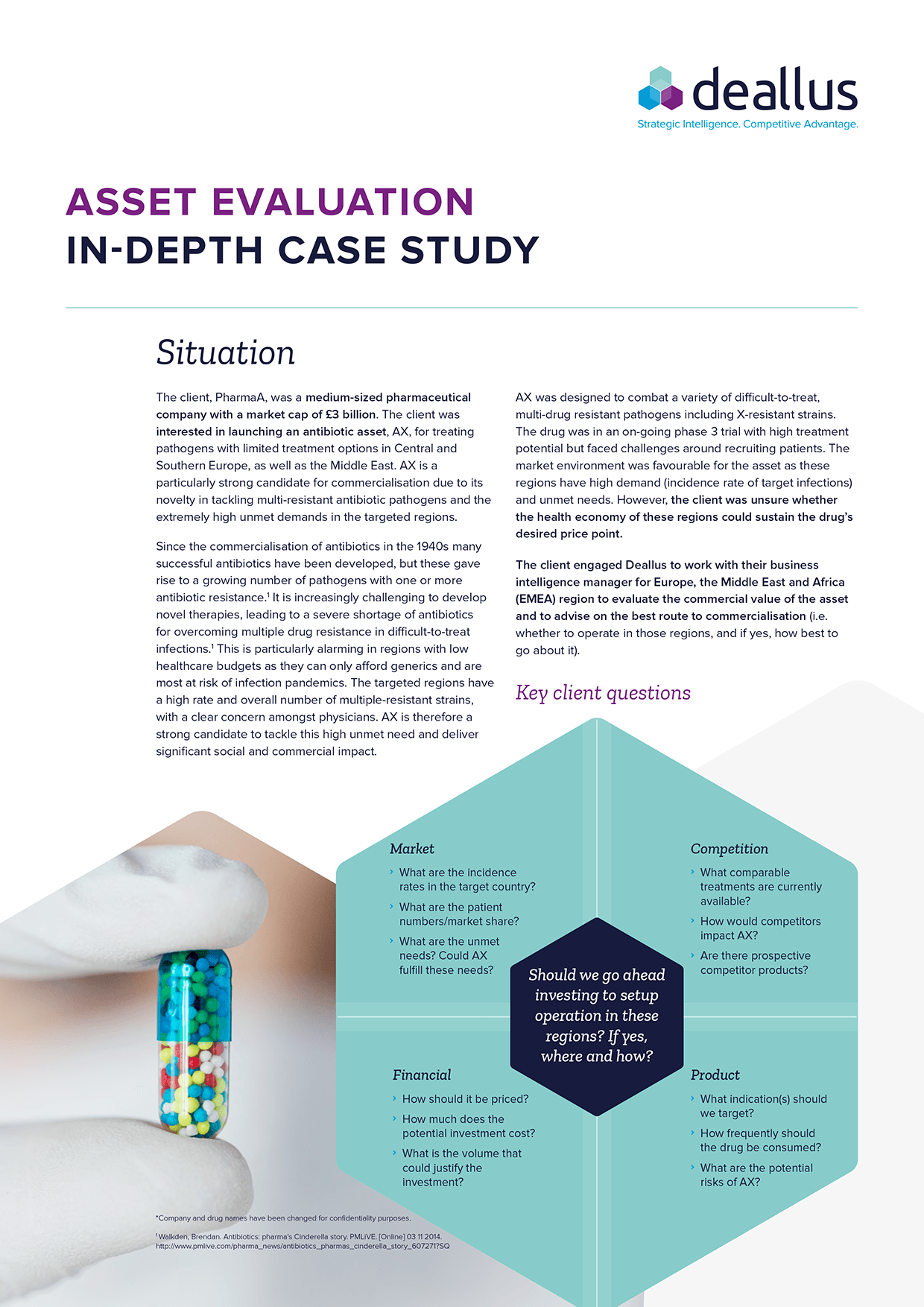

The client, PharmaA, was a medium-sized pharmaceutical company with a market cap of £3 billion. The client was interested in launching an antibiotic asset, AX, for treating pathogens with limited treatment options in Central and Southern Europe, as well as the Middle East. AX is a particularly strong candidate for commercialisation due to its novelty in tackling multi-resistant antibiotic pathogens and the extremely high unmet demands in the targeted regions.

Since the commercialisation of antibiotics in the 1940s many successful antibiotics have been developed, but these gave rise to a growing number of pathogens with one or more antibiotic resistance.1 It is increasingly challenging to develop novel therapies, leading to a severe shortage of antibiotics for overcoming multiple drug resistance in difficult-to-treat infections.1 This is particularly alarming in regions with low healthcare budgets as they can only afford generics and are most at risk of infection pandemics. The targeted regions have a high rate and overall number of multiple-resistant strains, with a clear concern amongst physicians. AX is therefore a strong candidate to tackle this high unmet need and deliver significant social and commercial impact.

AX was designed to combat a variety of difficult-to-treat, multi-drug resistant pathogens including X-resistant strains. The drug was in an on-going phase 3 trial with high treatment potential but faced challenges around recruiting patients. The market environment was favourable for the asset as these regions have high demand (incidence rate of target infections) and unmet needs. However, the client was unsure whether the health economy of these regions could sustain the drug’s desired price point.

The client engaged Deallus to work with their business intelligence manager for Europe, the Middle East and Africa (EMEA) region to evaluate the commercial value of the asset and to advise on the best route to commercialisation (i.e. whether to operate in those regions, and if yes, how best to go about it).